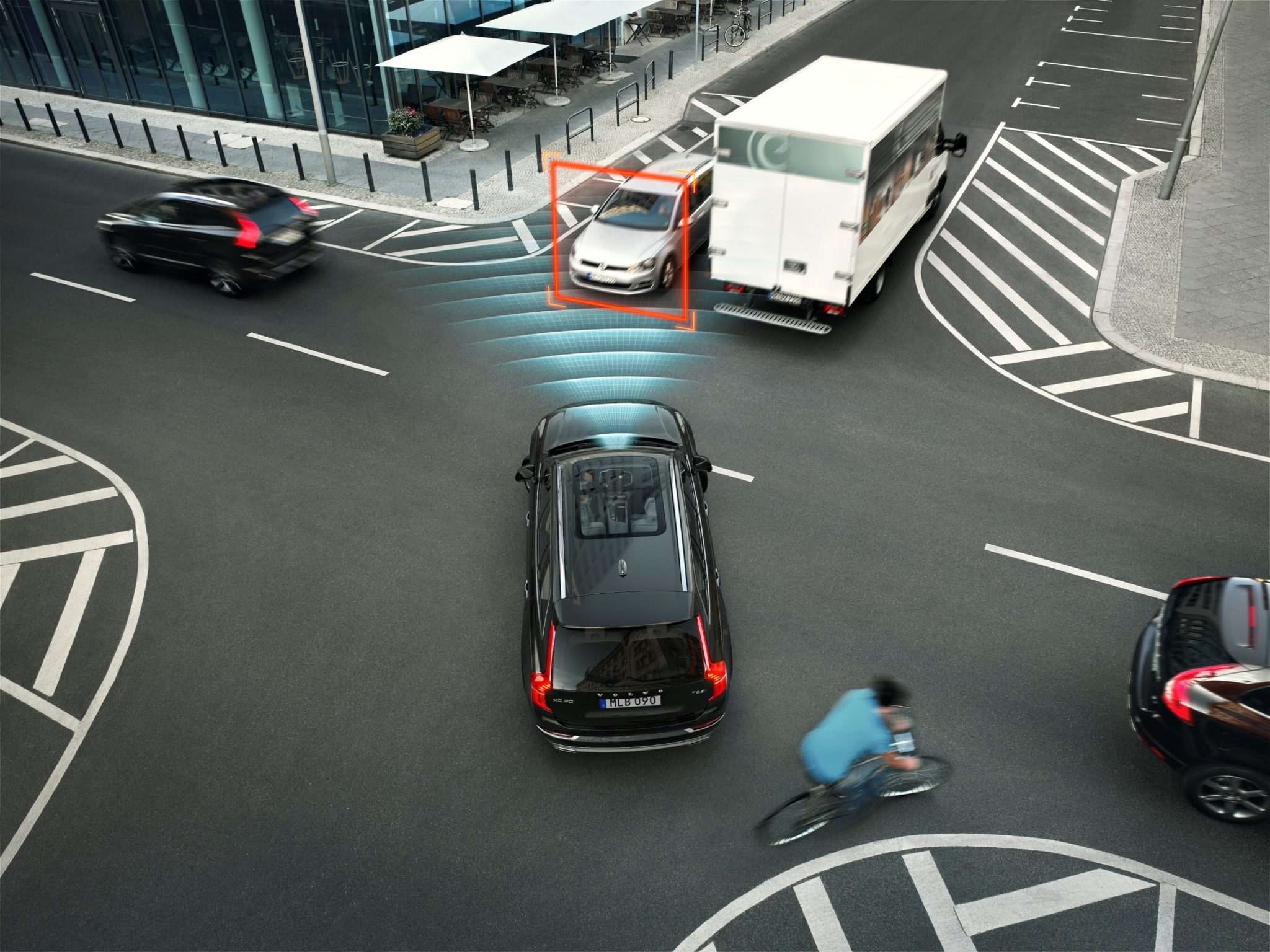

Some alerts on Advanced Driver Assistance Systems (ADAS) are so annoying or bothersome that many drivers disable the systems and may try to avoid them on future vehicle purchases, according to the J.D. Power 2019 U.S. Tech Experience Index (TXI) Study.

This is a major concern for automakers keen to market these lucrative technologies and pave the way for more highly automated vehicles in the future.

“Automakers are spending lots of money on advanced technology development, but the constant alerts can confuse and frustrate drivers,” said Kristin Kolodge, Executive Director of Driver Interaction & Human Machine Interface Research at J.D. Power. “The technology can’t come across as a nagging parent; no one wants to be constantly told they aren’t driving correctly.”

A prime example of this is lane-keeping and centering systems.

On average, 23% of customers with these systems complain that the alerts are annoying or bothersome. This ranges from just 8% for one domestic brand to more than 30% for a couple of import brands.

For these owners, 61% sometimes disable the system, compared with just 21% of those that don’t consider the alerts annoying or bothersome. Owners wanting the feature on their next vehicle ranges from 63% for those that consider the alerts annoying or bothersome to 91% for those who do not.

Kolodge also points out the significant differences across brands. “Some brands are succeeding at making their safety technology effective without being overbearing. Some are good at one aspect but weaker at another, and some are struggling with both. This is why one brand has 90% of its customers wanting lane-keeping/centering on their next vehicle, while another brand has just 59% of its customers saying the same thing.”

Overall satisfaction with new-vehicle technology ranges widely across the vehicles in the study. The best-performing vehicle in the study is the Kia Stinger, scoring 834 (on a 1,000-point scale). The overall average is 781, with the lowest-scoring model achieving just 709.

The study, now in its fourth year, measures owners’ experiences, usage and interaction with 38 driver-centric vehicle technologies at 90 days of ownership. The study provides clarity to auto manufacturers, insurance carriers, telecommunications companies and consumer electronic companies regarding ways to minimize the gap between driver experience and technology feature execution. The major technology categories analyzed in the study are entertainment and connectivity; collision protection; comfort and convenience; driving assistance; smartphone mirroring; and navigation.

Collision protection has the highest score (813) among the six categories measured in the study. Smartphone mirroring (789) is second, followed by comfort and convenience (787); entertainment and connectivity (782); driving assistance (768); and navigation (744).

Following are additional key findings of the 2019 study:

• Apple and Google taking over? More than half (69%) of respondents say they have Apple CarPlay and/or Android Auto in their vehicle. This is starting to jeopardize future sales of the automakers’ factory-installed navigation systems. More than two-thirds (68%) of owners with Apple CarPlay and/or Android Auto want factory-installed navigation on their next vehicle, compared with 72% of those without Apple CarPlay or Android Auto. This is a significant future profit loss for the automakers.

• Built-in apps not meeting users’ expectations: The attribute for “ease of using built-in apps” is the lowest-performing attribute in the entertainment and connectivity category (7.63 on a 10-point scale). Among the 29% of owners who have discontinued the use of built-in apps, 46% say they “do not need it” and 18% say they “have another device that performs the function better.” Apps on external devices are a competitive threat, so it’s imperative for automakers to ensure intuitiveness and ease of use.

• High satisfaction drives recommendation and repurchase intent: Owner satisfaction with their vehicle technology experience strongly determines whether they will recommend or repurchase the brand. When overall satisfaction is greater than 900, 75% “definitely will” repurchase the same make again and 95% “definitely will” recommend it. Automakers looking to drive loyalty need to provide a highly satisfying tech usage experience.

“Consumers are still very concerned about cars being able to drive themselves, and they want more information about these complex systems, as well as more channels to learn how to use them or how and why they kick in,” Kolodge said. “If they can’t be sold on lane-keeping—a core technology of self-driving—how are they going to accept fully automated vehicles? Dealers remain a partner in the process of helping translate to consumers what these technologies bring to the table, but consumers still need that element of trust that systems are going to kick in when they’re supposed to. It’s essential that the industry recognize the importance of an owner’s first experience with these lower-level automated technologies because this will help determine the future of adoption of fully automated vehicles.”

0 Comments